Gold has been a preferred currency for civilizations throughout history. Today, it continues to be an excellent alternative to traditional stock and bond markets. In fact, the demand for gold grew by 18.1% compared to the previous year, further emphasizing its appeal. To get things started, familiarize yourself with Bullion vs Investment Grade.

Additionally, gold acts as a hedge against inflation; its value increases along with the cost of goods. Due to its relative scarcity, gold tends to maintain its purchasing power better even as low-interest rates push up prices. If you are considering investing in gold, here are four options to choose from:

1. Gold Bullion

The most popular style of direct possession of gold is through gold bullion; pure or almost pure gold verified for its weight and purity. Gold bars, coins, and other gold-containing items of any weight are all included. Note that large-size bars have less liquidity than other options because they can be costly to purchase and sell and cannot be easily divided for resale.

You can purchase gold bullion coins from private sellers at a premium of 1% to 10% over the value of the underlying gold. Due to their small size and ease of selling, gold coins are a practical option for investors. You can also find reputable dealers easily with a little searching.

One potential drawback is that bullion coins come with a relatively significant markup from both dealers, which reduces profit. Additionally, owning physical gold requires safe storage, like bank safety deposit boxes or vaults, as physical gold is susceptible to theft.

2. Gold ETFs and Mutual Funds

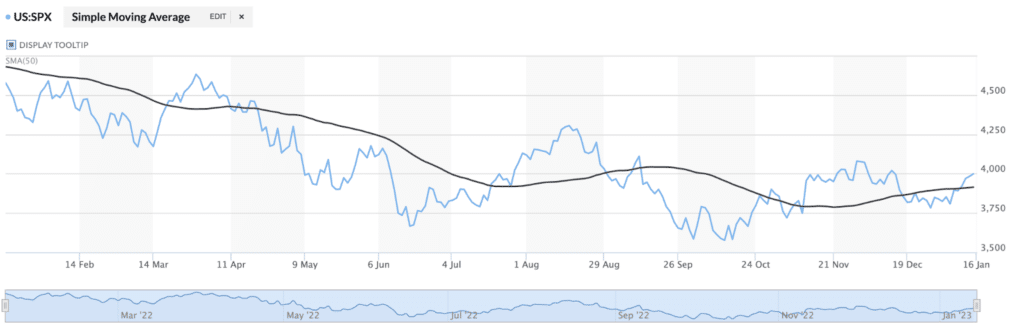

You can engage in gold investment through a Gold Exchange Traded Fund (ETF) without purchasing actual gold assets. An ETF is an investment fund that can be bought and traded in any brokerage or individual retirement account. (IRA) like stocks. In 2022, ETFs had 0.2% higher compound annual returns than physical gold. ETF shares reflect a fixed quantity of gold, like a one-fifth part of an ounce. Their performance and worth are based on the underlying asset of the company. These are perfect for small investors as the lowest investment requirement equals the price of one share in the ETF.

3. Gold Mining Companies

Investing in Mining and refining companies can be a low-risk method to profit from gold as the gold mining industry is predicted to grow up to $249.6 billion by 2026, with a CAGR of 3.1%. The shares of gold mining companies go up as gold prices rise, increasing the value of the company’s gold inventory.

Large gold mining firms have extensive global operations, meaning they can profit even when gold prices are stagnant or falling. With skilled management, these companies can reduce their extraction costs and increase gold output. However, if you invest in companies with bad management, it may lead to less gold being extracted at a higher cost.

Poor management adds a risk element to mining companies. And factors such as gearing or the company’s debt level, as well as any possible effects of environmental or legal regulations on its current operations, can increase risk. So, extensive research is necessary to select a suitable gold mining company.

4. Gold Jewelry

Gold jewelry is a popular option due to its high demand in the gold industry, accounting for 55.43% of the total demand for gold. There is a significant markup when purchasing jewelry at retail costs; up to 300% or more over the gold’s actual worth. Auctions and estate sales often have better gold deals where there is no retail markup, but a lot of time is required to find suitable items. While owning gold jewelry is an enjoyable method to possess gold, it is not the most profitable choice for an investor. Storage can be another issue, since it is susceptible to theft.

Endnote

Gold is a tangible asset that is likely to hold its purchasing power amidst changing economic conditions. Gold bullions are excellent for large investors looking for direct exposure to the gold market because they physically own the gold itself, which has a value based on the current market price. Also, large investors may have the budget to pay for the premium to dealers and storage, making it an ideal option for them. For beginners, ETFs are the easiest and safest way to invest in gold due to their low cost and convenience of buying and selling them.