Consumer lending is undergoing structural change. What began as broad-based marketplace lending has evolved into increasingly specialized credit ecosystems, and healthcare is emerging as one of the most dynamic verticals.

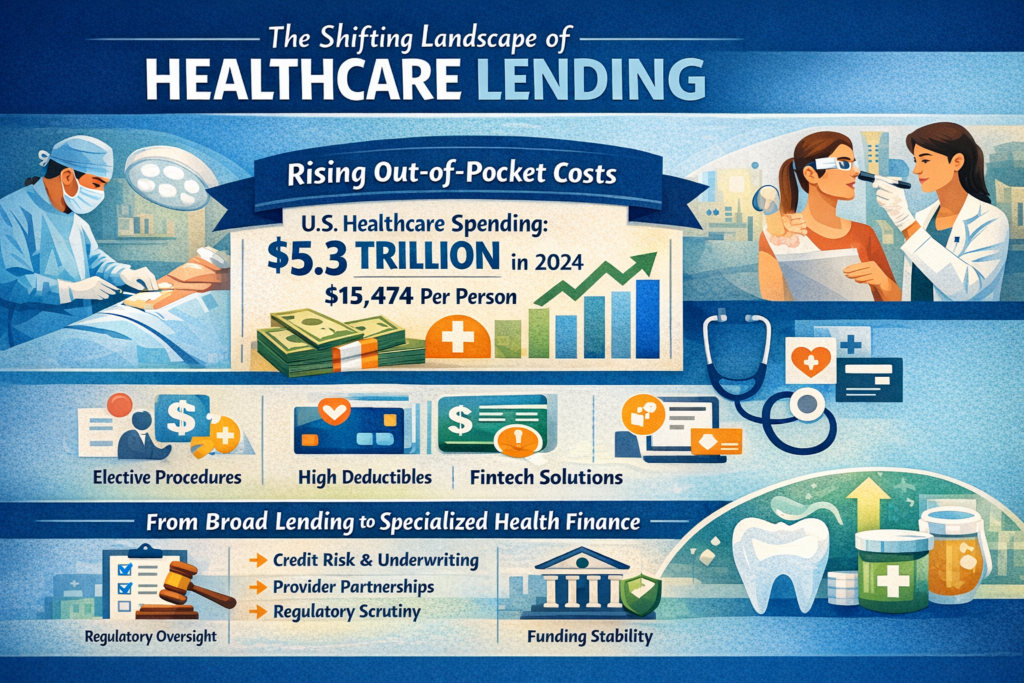

Out-of-pocket costs are rising, more people are choosing elective procedures, and fintech companies are finding new ways to process payments. All of these changes are quietly reshaping how Americans pay for healthcare. They also raise important questions for lenders, investors, and regulators who are trying to keep up with a market that is still taking shape.

Healthcare Spending Creates Structural Demand

The numbers alone tell part of the story. U.S. healthcare spending hit $5.3 trillion in 2024 — roughly $15,474 per person — marking the second consecutive year of growth above 7 percent. Utilization is up, pandemic-era demand never fully unwound, and prices keep climbing.

But the more interesting dynamic isn’t what’s happening at the system level. It’s what’s happening at the patient level. High-deductible plans have quietly shifted a much larger share of costs onto individuals, and that shift is showing up at the point of care in ways providers can’t ignore.

Even though public and private insurance cover much of these costs, households are paying more out of pocket through deductibles, co-pays, and elective procedures. High-deductible health plans have also put more of the initial costs on patients.

At the same time, global aesthetic and elective treatment markets are expanding. The global cosmetic surgery market reached $85.83 billion in 2025, with North America accounting for more than 30 percent of the market share. Non-surgical procedures in the United States alone generated $17.5 billion in 2024. Dental, fertility, hearing, and veterinary services add further layers to the addressable market.

The result is a patient who is both more cost-conscious and more likely to need a payment option to move forward with care, elective or otherwise.

From Marketplace Lending to Vertical Specialization

The first generation of fintech lenders focused on broad unsecured personal loans. Platforms such as LendingClub helped popularize marketplace models that connected borrowers and investors while competing directly with traditional banks on speed and user experience.

As the sector matured, margin compression, regulatory scrutiny, and funding costs prompted strategic pivots. Some lenders sought bank charters to stabilize funding structures. Others moved toward point-of-sale integration to capture opportunities in embedded finance.

Healthcare represents a logical next step in this evolution. Unlike general consumer lending, medical finance benefits from several structural characteristics. Transactions are frequently associated with specific services, average transaction values provide significant insights, and the necessity of treatment can affect repayment behavior.

Consequently, an expanding ecosystem of alternative healthcare lending platforms has developed. It’s no longer just insurance companies and health savings accounts; it’s a mixture of established medical credit card providers, general buy-now-pay-later (BNPL) companies, and specialized platforms developed exclusively for healthcare providers.

Competitive Differentiation in a Fragmented Market

The healthcare financing space has gotten crowded, changing the game for lenders. Competitive advantage used to be mostly about how much capital you had and how many relationships you had. Now it comes down to how well you actually run the business.

Lenders that take a rigorous approach to credit risk, cultivate deep provider partnerships, and deploy capital thoughtfully tend to build more durable platforms than those simply competing on rate or reach. In a rate environment that keeps shifting, the operational details matter more than ever: how cleanly your technology plugs into practice management systems, how clearly repayment terms are structured, how disciplined the underwriting really is.

Providers have figured this out, too. Offering patients a structured way to pay moves the needle on case acceptance, reduces the revenue that walks out the door when patients delay or decline treatment, and smooths out cash flow in ways that matter to a practice’s bottom line. For larger groups, and especially those with private equity backing, that realization has elevated financing from a back-office function to a genuine growth lever.

Regulatory and Risk Considerations

Despite its growth, healthcare finance remains complex and subject to regulatory oversight.

In the United States, the Consumer Financial Protection Bureau is paying closer attention to medical debt, deferred-interest plans, and transparency rules. Oversight at the state level adds more differences. Companies without bank charters face different compliance requirements than federally regulated banks, which creates an uneven playing field.

Credit risk is changing as well. Higher interest rates and growing household debt, combined with overall economic uncertainty, are making the performance of unsecured lending portfolios more unpredictable. Healthcare finance may exhibit different repayment dynamics than discretionary retail credit, but it is not immune to consumer stress.

Around the world, regulations are even less consistent. In countries with universal healthcare, private medical loans are usually only for elective or cosmetic procedures, and they are less stringent. In emerging markets, expanding healthcare credit can help more people access financial services, but it also brings new regulatory and governance challenges.

Capital Allocation and Strategic Outlook

For institutional investors and strategic acquirers, verticalized healthcare finance presents both opportunity and complexity.

The total addressable market is supported by persistent growth in healthcare expenditure and consumer payment friction. Embedded finance within clinical workflows creates defensible distribution channels. Data-rich environments continually enhance underwriting models.

However, platform durability will depend on funding resilience, regulatory adaptability, and disciplined risk management. Bank-chartered models, marketplace funding structure’s and hybrid balance sheet approaches will likely continue to coexist.

Healthcare didn’t become an interesting lending vertical by accident. It got there because the underlying demand is persistent, the distribution opportunity inside clinical workflows is real, and the data available to underwriters keeps improving. What’s less certain is which platforms are actually built to last — and that question comes down to funding resilience, regulatory positioning, and whether the credit discipline holds when the economic environment gets harder.

The lenders worth watching are the ones treating those as core competencies, not afterthoughts.