Taxpayers can feel that it’s already too late to save money on their taxes. You have already earned most of your income for 2022, but you may still make some smart moves to lower the amount of tax.

If you’ve already read every article, overview by Paydaysay, and don’t know what to do with your taxes, there are even more options both for small business owners with stable incomes and for ordinary people. Keep on reading to learn how to boost your tax refund and what strategies can help you reduce your tax bill in 2022.

Make an IRA Contribution

Do you know that your contributions to an IRA may be tax-deductible? You can deduct your contributions to a traditional individual retirement account in the year you make them.

There are various situations that refer to various IRS regulations regarding IRA contributions. Consumers can typically deduct the entire sum of their IRA contribution in case retirement plans don’t cover them at work.

The contribution to this account may be limited if the taxpayer or their spouse are covered. Those who are in the top bracket of 37 percent and contribute $6,000 to their IRA account, which is the maximum sum for this year, can save $2,220 in their 2022 taxes. More than that, you have a chance to contribute to this account until the tax filing day.

Defer Your Income

Consumers prefer to wait longer to pay their taxes. During this time, half of them look for an alternative way to find money, for instance, using payday advance app from PayDaySay or just borrowing from their parents. Others are looking for a more formal way out of the situation. One of the options to delay this payment is to defer your profit from this year into the next one. It will lower your taxable income for the current year.

For instance, workers who are due a bonus at work at the end of this year may ask their recruiter if they plan to defer this payment into 2023. On the one hand, this option works well for saving your taxes in the current year.

On the other hand, you will need to balance any present tax savings with the potential taxes you will have in the future. Besides, deferring your current income can lead to some tax issues next year, especially if you are in a higher tax bracket. Still, this option is suitable if your aim is to lower your tax bill for 2022.

Try Tax-Loss Harvesting

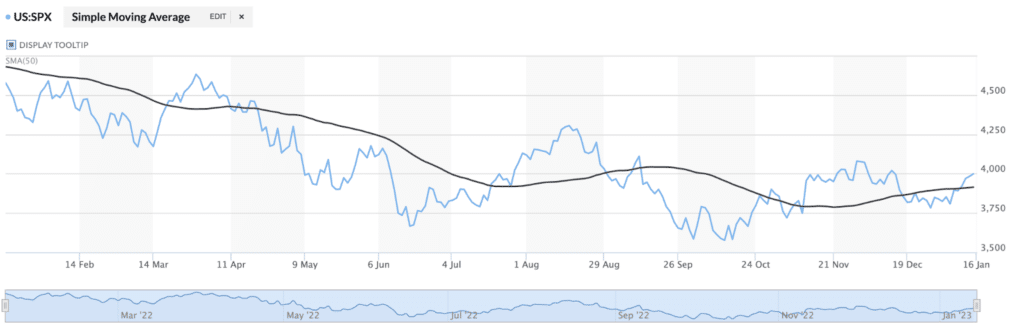

The S&P 500 Index is down almost 20 percent for 2022 as of December 19. What does it mean for taxpayers? It is a reasonable option to start tax-loss harvesting. This strategy will help you offset brokerage account revenue with losses. Once you lower the 2022 investment profit, you will be able to utilize extra losses to decrease regular profit by $3,000.

The remaining losses will be carried forward to the next tax years. A chart from MarketWatch demonstrates that US: SPX was 3,912.52 on January 10, 2023, compared to 4,727.35 in January 2022.

Boost Retirement Plan Contributions

What can you do if your year-end income estimate demonstrates the possibility of being in a higher tax bracket? In this case, you should make or boost your retirement plan contributions.

Taxpayers may increase their employer-sponsored retirement plan or IRA contributions until April’s filing deadline. Yet, your 401(k) and 403(b) contributions should be ready by the end of December. People over 50 years old may boost their tax deduction by making catch-up contributions to the majority of plans.

Select the Cost Basis Wisely

Taxpayers can calculate their cost basis with the help of different tools. The strategy you need to select can differ from one year to another. It can actually make a difference for taxpayers willing to reduce their tax bill.

Consumers can select to utilize an identical number of shares that were bought at a higher price as the basis if they made a lot of money selling shares and need to declare this profit. This option may come with tough regulations and demand assistance from specialists.

Choose to donate all or some of your appreciated shares to charity in case you don’t own any lots for the basis. A tax deduction up to particular limits can be taken for the full fair market value.

You will be able to avoid capital gains at all if you have had these securities for over a year. Reporting and computing cost basis will become more convenient as monetary companies have been obliged by law to provide this information for your buy and sell transactions every year.

Bunch Your Expenses

Are you a business owner? Entrepreneurs have the right to deduct a variety of expenses related to their venture. It is another suitable way to lower your tax bill if you are a small business owner. Bunch your business-related expenses as much as possible into the present year to lower income taxes.

What are the most widespread tax methods? You may want to pay your workers bonuses at year-end instead of at the beginning of the year. You may decide to make upcoming big-picture purchases related to your venture at the end of 2022 rather than at the beginning of 2023. Prepaying your business-related costs is another option.

In case you spend $3,000 each month to purchase business supplies, you may want to buy $9,000 worth at year-end to help you get through the coming three months. Entrepreneurs will be able to deduct their income tax for a certain business cost if they make a bulk purchase at the end of the year.

Get Written Deductions

Have you made any charitable contributions in 2022? You should receive a written receipt for your records. It will help you deduce these donations if they are over $250. The IRS requires taxpayers to have a receipt to prove these contributions. You need to submit them on Schedule A and ensure you can assert that these deductions and contributions are genuine.

The Conclusion

In conclusion, you still have some time to follow these tips and use our strategies to reduce your tax bill in 2022. Consider these methods of lowering your taxes so that you don’t feel upset when time passes and it becomes too late. Be proactive and use this last chance to reduce your taxes, or consult a financial advisor if you have additional questions.