The majority of CEOs in Saudi Arabia are integrating environmental, social and governance (ESG) practices into their business strategies for sustainable growth, as their risk profile shifts towards disruptive technology and environmental concerns, reveals KPMG in their annual CEO Outlook.

The CEU Outlook Saudi Arabia 2021: Purpose-led and prepared for growth is based on a global survey among 1,325 CEOs including 50 in Saudi Arabia, taking additional insight from interviews with business leaders in the Kingdom. All respondents based in the Kingdom represent companies with revenues greater than US$500 million and 60% of the companies have revenues greater than US$1 billion.

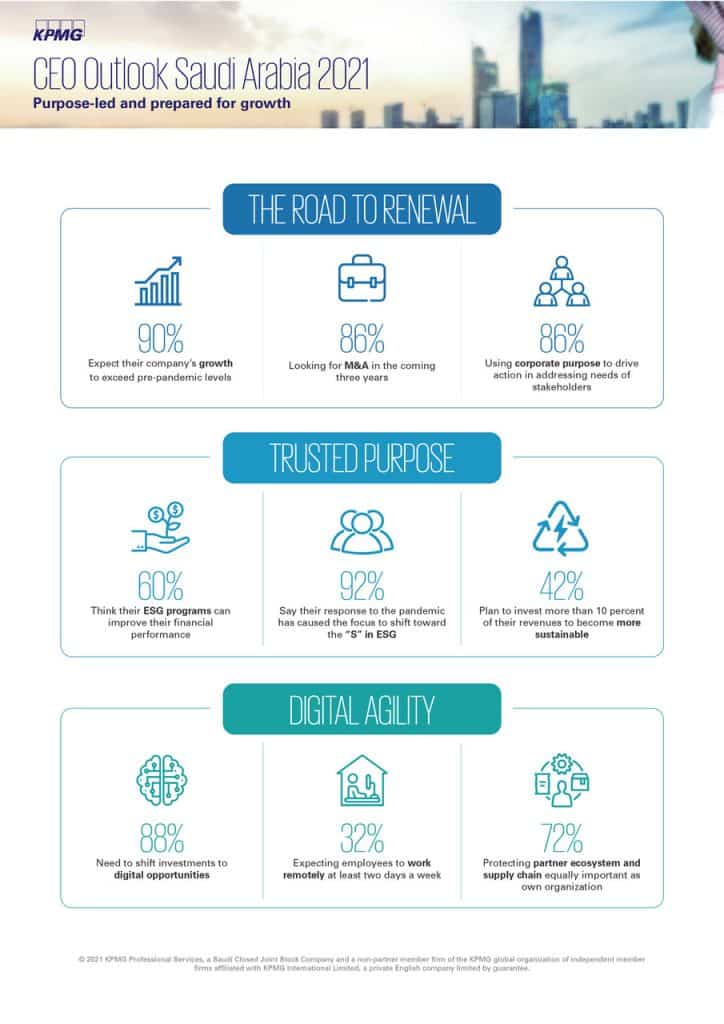

Given increasing stakeholder pressure, CEOs are putting people first to drive societal return and 92% of surveyed CEOs in the Kingdom comment their response to the pandemic has caused their focus to shift to the social component of their ESG programs. On the other hand, a mere 30% of CEOs in the Kingdom feel they will struggle to meet diversity and inclusion expectations, compared to 56% globally.

Making progress on climate change will require action from both businesses and government, with KPMG’s report finding 42% of Saudi-based CEOs intending to invest more than 10% of their revenues in becoming more sustainable. Six in ten CEOs in the Kingdom found their ESG programs improve financial performance.

“We notice that CEOs are putting ESG at the center of their organization’s long-term growth strategies. It’s been encouraging to see this trend and to see business leaders successfully tie their organization’s economic success to their ESG agendas. CEOs have proven they can be drivers of positive change,” commented Dr. Abdullah Al Fozan, Chairman of KPMG in Saudi Arabia.

According to the publication, CEOs in Saudi Arabia are optimistic, confident and expect aggressive growth through acquisitions, as well as other inorganic methods. Nearly 86% of CEOs in the Kingdom are looking at mergers and acquisitions (M&A) deals as a means of growth in the next three years. As similar figure of 88% finds they need to be quicker to shift investments to digital opportunities.

In Saudi Arabia, 84% of the CEOs have confidence in the Kingdom’s growth, while 90% expect their company to exceed pre-pandemic levels. “The pandemic is not over, but CEOs are increasingly confident about economic growth in Saudi Arabia and globally,” added Dr. Al Fozan.

“With potential abound, CEOs are hoping to get on the front foot to position their businesses to capture it. Inorganic growth strategies are a popular choice to seize these opportunities. Business leaders are looking to expand organically and continue to assess the future of work to ensure they can attract top talent.”

CEOs emphasize leading with purpose, focusing on digitally transforming their organizations and upskilling an agile workforce.

CEOs in Saudi Arabia are strengthening their organization’s digital advantage by building a more flexible future of work and operating as part of digital ecosystems. Although wholesale changes to the office setup are uncommon, CEOs are more flexible, with 32% expecting most employees to work remotely at least two days a week and 28% considering hiring talent to work remotely.

KPMG advises three action areas that CEOs can focus on as they look to grow beyond the impact of the pandemic: growth and resilience, ESG and financial value and future of work.

Many organizations coped exceptionally well with the pandemic, showing resilience as they dealt with notable change, uncertainty and disruption.

“Resilience will be key to economic recovery. Along with specific interventions — from managing talent risk to building cyber defenses — CEOs will need to surround themselves with resilient people. They will also need to identify the ESG investments that are necessary to drive long-term value.”

“CEOs need to have a people-first mindset — investing in new technologies and human capability. They need to be purpose-led — winning the trust of stakeholders and helping build a more prosperous and sustainable world,” Dr. Al Fozan concluded.